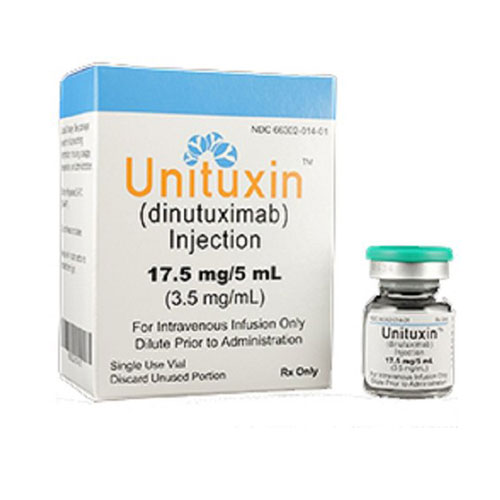

It has been decided to exempt GST on Dinutuximab (Quarziba) medicine when imported for personal use.

GST Council has recommended the exemption of cancer-related drugs, medicines for rare diseases and food products for special medical purposes from GST tax paving the way for these medicines to become cheaper.

The decision was taken at the GST Council meeting on Tuesday headed by Finance Minister Nirmala Sitharaman

“It has been decided to exempt GST on Dinutuximab (Quarziba) medicine when imported for personal use,” according to a finance ministry statement issued after the meeting.

It has also been decided to exempt IGST on medicines and Food for Special Medical Purposes (FSMP) used in the treatment of rare diseases enlisted under the National Policy for Rare Diseases, 2021 when imported for personal use subject to existing conditions. Similarly, IGST exemption is also being extended to FSMP when imported by Centres of Excellence for Rare Diseases or any person or institution on recommendation of any of the listed Centres of Excellence, the statement said.

The Council also decided to lower the service tax levied on food and beverages consumed at cinema halls to 5 per cent from 18 per cent, and tweaked the definition of Sports Utility Vehicle (SUV) for levying a cess over and above the GST rate.

Finance Minister Sitharaman said currently the definition of an SUV for levy of cess includes four parameters — should be popularly known as SUV, should be of length of 4 meters or above, should have an engine capacity of 1,500 cc and above and unladed ground clearance of minimum 170 mm.

The Council has decided to scrap the condition that the vehicle should be popularly seen as an SUV, and stressed that the ground clearance of 170 mm should be of an unladen vehicle.

The GST Council also approved the imposition of a uniform 28 per cent tax on full “face value” of bets involving online gaming, casinos and horse racing. This will bring them on a par with betting and gambling. Industry stakeholders had been arguing that games of skill be treated differently from games of chance for tax purposes.

The effective tax rate on online gaming will be rolled out after amendments to the GST law. “Will bring an amendment to the GST law to include online gaming and it will be taxed at 28 per cent on full face value,” the Finance Minister said.

Currently, most online gaming platforms pay an 18 per cent tax on the commission collected for each game. Those involved in betting or gambling attract 28 per cent GST. For horse racing, GST is levied at 28 per cent on the bet value.

Minister for Electronics and Information Technology Ashwini Vaishnaw said on Friday that the government is…

Renowned human rights activist and political analyst Amjad Ayub Mirza has expressed a strong denunciation…

As was widely expected, the Indian economy grew by 6.5 per cent in real terms…

World No Tobacco Day, marked annually on 31 May, addresses a major public health challenge--the…

Defence Minister Rajnath Singh, addressing officers and sailors onboard India's first indigenous aircraft carrier INS…

The leadership team from the Central Tibetan Administration (CTA) arrived in Tokyo to participate in…