Women empowerment critical for India's economic development

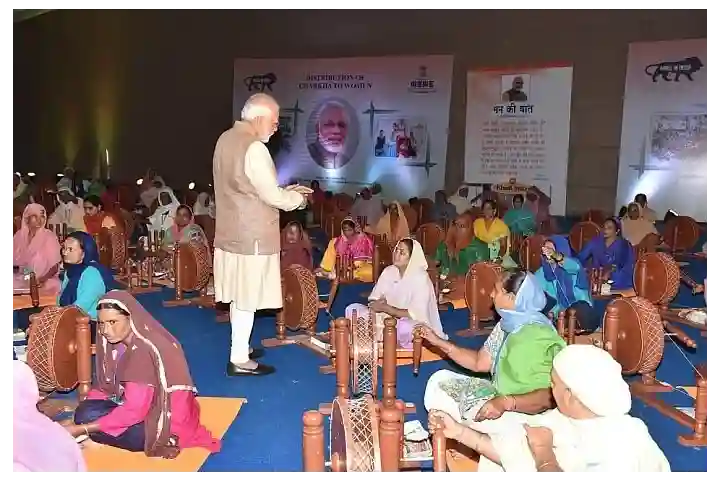

More than 60 per cent of the account holders under the Pradhan Mantri Jan Dhan Yojana scheme are women. More importantly 67 per cent of the account holders are in the rural and semi-urban areas. The scheme launched by the Narendra Modi government in 2014 was aimed at expanding the scope of financial inclusion. According to official data, financial literacy among women has also improved while the number of women entrepreneurs has also grown.

Since its launch, 46 crore bank accounts have been opened with a total deposit of Rs 1.74 lakh crore.

“Financial inclusion is a major step towards inclusive growth which ensures the overall economic development of the marginalised sections of the society,” Finance Minister Nirmala Sitharaman said on its eighth anniversary.

The focus of PMDJY has now shifted from plan envisaging “every household’ to “every adult” by enhancing the direct benefit transfer (DBT) flows through the bank accounts, promoting digital payments mechanisms.

Sitharaman added that the financial Inclusion exercise needs policy-led intervention based on an architecture linked to suitable financial products, information and communication technologies and data infrastructure. “The country has adopted this strategy since the launch of PMJDY to optimise the intended benefits of the scheme for the people of the country. I thank all the field functionaries for their untiring efforts in making PMJDY a grand success,” she said.

During first year of scheme 17.90 crore PMJDY accounts were opened. According to an official statement, the average deposit per account is Rs. 3,761 while the average deposit per account has increased over 2.9 times compared to 2015.

Nirupama Soundararajan, chief executive officer, Pahle India Foundation told India Narrative that access to credit for women opens up a new market. “This will boost women entrepreneurship, we can already see that happening. Having a bank account is the first step, which will then open up other areas of financial empowerment such as insurance and investments,” Soundararajan said.

Also read: Centre shifts gears: From India@75, all eyes now on India@100

External Affairs Ministry Spokesperson Randhir Jaiswal on Thursday has reiterated India's stance on bilateral discussions…

India implemented a new visa module for Afghan nationals on April 29, Ministry of External…

India is in touch with Iranian authorities for locating three Indian nationals who went missing…

A citywide closure occurred throughout the Awaran district in Balochistan on Wednesday, with shops, businesses,…

The Czech Republic's government has officially linked a malicious cyberattack on its Ministry of Foreign…

Chief of Defence Staff General Anil Chauhan will visit Singapore from May 30 to June…