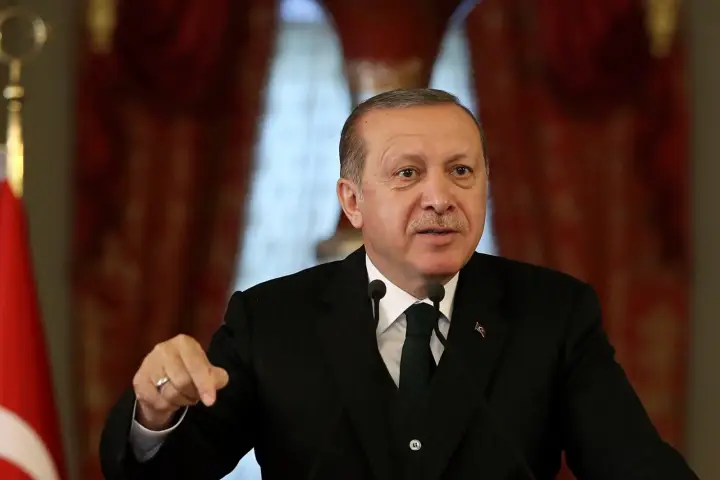

Amid rapidly deteriorating macroeconomic situation in Turkey, the road ahead for the country’s President Recep Tayyip Erdogan is set to get tougher. Turkey is slated to go to polls in June next year amid a crumbling economic fabric. In April, Turkey’s inflation rate measured in terms of consumer price index just fell shy of 70 per cent to 69.97 per cent. Despite skyrocketing inflation, an adamant Erdogan is continuing with a low interest rate policy, citing the principles of Islamic banking.

"As a Muslim, I will continue doing what our religion tells us. This is the command," Erdogan, responsible for the radical transformation of the country, said in a televised address to the nation in December.

He added that Turkey has abandoned the monetary policy based on high interest rates that caused several developing countries to remain stagnant. Erdogan hoped that a low interest rate regime would push manufacturing, but Turkey’s Purchasing Managers’ Index (PMI), a key assessment of business conditions in the manufacturing sector, fell to 49.2 in April from 49.4 in March, signaling a further contraction in factory activity. The April PMI reading was the lowest since May 2020. In fact, the PMI reading has been consistently falling since the beginning of the year.

Notwithstanding the surging inflation rate, Turkey’s Treasury and Finance Minister Nureddin Nebati assured that the inflationary trend was not worrying that it would "not spread over the long term and be permanent."

According to the Turkish central bank’s forecast the annual inflation rate will peak at around 70 per cent by June and then it will start to come down to about 43 per cent by the end of the year and touch single digits by end-2024.

“The central bank has lost its autonomy, central bank governors have been changed in quick succession..so we have to see if these projections have any real meaning,” an analyst told India Narrative.

The economic situation has worsened with the Russia-Ukraine conflict. Almost all of Turkey’s oil and gas requirements are imported. Trade deficit widened to $6.1 billion last month.

While the Turkish lira has somewhat stabilised after a host of measures undertaken by the Turkish central bank, it was the worst performing currency in the world in 2021. With an eye to supporting the lira, the country’s central bank has put in place new reserve requirement rules for banks to control loan growth and encourage conversion of foreign currencies to the lira.

“With the trade deficit widening and inflation surging, imbalances in Turkey’s economy are threatening to scupper the government’s economic programme,” online news portal Ahval said.

Erdogan’s Saudi visit

A desperate Erdogan is hoping that his recent visit to Saudi Arabia would usher in “a new era.” His visit to Saudi was the first since 2017.

News portal the New Arab said that the president’s popularity is waning with the decline in the economic macro indicators. “He desperately needs foreign investment in the country,” the news portal said.

Erdogan starts preparing for polls

Erdogan, who has been in power since 2002, is doing his best to ensure that he retains the presidency especially after the setback in the local elections in 2019. He suffered defeat in Istanbul as well as in Ankara.

Last month, he introduced major changes in the country’s electoral rules. Erdogan’s new rules have made it tougher for the smaller parties to win seats on their own though the threshold for any party to enter Parliament has been reduced. Under the new regulations, the president will also be exempt from rules that ban ministers from using state resources to organize their campaigns or attend rallies, Bloomberg said.

Also read: Imprisonment for analysts in Turkey for publishing independent macroeconomic data?

Turkey turns innovative – uses wind energy from moving vehicles to generate electricity