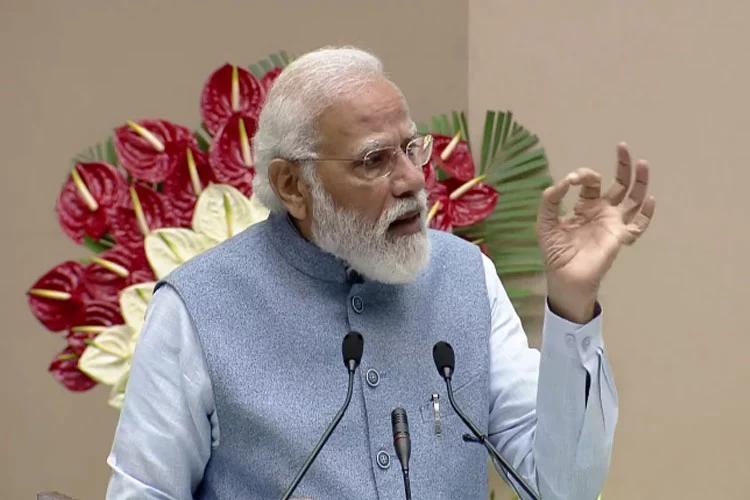

PM Modi addresses depositors in a bank deposit insurance programme in Delhi.

<p>

Prime Minister Narendra Modi on Sunday handed over cheques to account holders of banks under the Guaranteed Deposit Insurance Payment scheme that the government has introduced to protect depositors in case a bank fails.</p>

<p>

Addressing the &lsquo;Depositors First&rsquo; function, the Prime Minister said, &ldquo;today is a very important day for the banking sector and crores of bank account holders of the country as this day is witnessing how a big problem which was going on for decades has been solved.&rdquo;</p>

<p>

PM Modi stressed that the spirit of &lsquo;Depositors First&rsquo; is very meaningful. In the last few days, more than one lakh depositors have got their money back that was stuck for years. This amount is more than Rs 1300 crore, he disclosed.</p>

<p>

The Prime Minister informed that the guaranteed amount that depositors will get in the case of a financial collapse of a bank has been raised from Rs 1 lakh to Rs 5 lakh under the &ldquo;Depositors First: Guaranteed Time-bound Deposit Insurance Payment&rdquo; scheme.</p>

<p>

&ldquo;Understanding the concern of the poor, understanding the concern of the middle class, we increased this amount to Rs 5 lakh&rdquo;, The Prime Minister said.</p>

<p>

He also explained that &ldquo;earlier there was no time limit for this refund, now our government has made it mandatory that in the event of a bank sinking, the depositors will get their money back within 90 days.&rdquo;</p>

<p>

Deposit insurance covers all deposits such as savings, fixed, current, recurring deposits, etc. in all commercial banks, functioning in India. Deposits in State, Central and Primary cooperative banks, functioning in States/Union Territories are also covered. In a path breaking reform, Bank deposit insurance cover was enhanced from Rs. 1 lakh to Rs. 5 lakh.</p>

<p>

The Prime Minister said any country can save the problems from getting worse only by timely resolution of them. However, he said, for years there was a tendency to avoid problems. Today&#39;s new India strives for solving problems, today India does not avoid problems, he added.</p>

<p>

With deposit insurance coverage of Rs. 5 lakh per depositor per bank, the number of fully protected accounts at end of previous financial year constituted 98.1% of the total number of accounts, as against the international benchmark of 80%.</p>

<p>

The first tranche of interim payments has been released by the Deposit Insurance and Credit Guarantee Corporation recently, against claims received from depositors of 16 Urban Cooperative Banks which are under restrictions by RBI. Payout of over Rs 1300 crore has been made to alternate bank accounts of over 1 lakh depositors against their claims.</p>

<p>

Also read: <a href="https://www.indianarrative.com/india-news/pm-modi-pays-tribute-to-general-rawat-says-despite-setback-nation-will-work-harder-to-become-stronger-134302.html">PM Modi pays tribute to General Rawat, says despite setback nation will work harder to become stronger</a></p>

Prime Minister Narendra Modi had a "fruitful conversation" with Finnish President Alexander Stubb on Wednesday…

US Vice President JD Vance is scheduled to visit India next week. He will meet…

In a first, Indian Railways has installed an ATM on a trial basis -- on…

Commerce Minister Piyush Goyal met a delegation from Elon Musk-owned satellite internet services company Starlink.…

The United States has enacted restrictions on the export of Nvidia's H20 chips to China,…

BusinessWire India QpiAI, a leader in quantum computing and generative AI, announced its First Quantum…