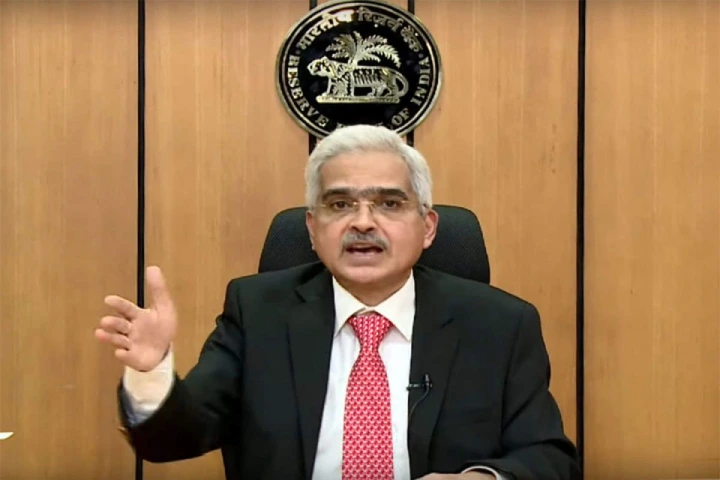

RBI Governor Shaktikanta Das (File Photo)

RBI Governor Shaktikanta Das highlighted the delicate balancing act faced by the central bank in the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meeting held from August 6 to 8.

The fiftieth meeting, conducted under Section 45ZB of the RBI Act, 1934, ended with the decision to keep the policy repo rate unchanged at 6.5 per cent, continuing the stance of withdrawal of accommodation.

Das said, “Inflation is gradually trending down, but the pace is slow and uneven. The durable alignment of inflation to the target of 4.0 per cent is still some distance away. Persistent food inflation is imparting stickiness to headline inflation. Inflation expectations need to be kept anchored.”

He added, “Spillovers of food inflation to core have to be avoided. At such a crucial juncture, steady growth impulses are allowing monetary policy to unambiguously focus on supporting a sustained descent of inflation to the target. The best contribution that monetary policy can make for sustainable growth is to maintain price stability. Taking all these factors into consideration, I vote for keeping the policy repo rate unchanged at 6.5 per cent and continuing with the stance of withdrawal of accommodation.”

Dr Michael Debabrata Patra, Deputy Governor, RBI expressed concern over the widening wedge between headline and food inflation, which has stalled the alignment of headline inflation with the target.

He said, “The monetary policy committee (MPC) of the RBI has committed to align inflation durably to the target. That is not yet achieved; any faltering from this commitment could undermine the prospects of the Indian economy. Hence, I vote for keeping the policy rate and the stance of withdrawal of accommodation unchanged in this resolution.”

The gap between headline and food inflation has been expanding, hindering the alignment of headline inflation with its target. With double-digit inflation persisting for several months in key food categories like cereals, pulses, spices, and vegetables, empirical data suggests that food inflation is becoming more persistent, taking longer to return to its trend after a shock.

Dr Rajiv Ranjan, member, MPC noted that while risks to the global economic outlook have increased, the domestic economy continues to exhibit resilience. However, he pointed out that the risks to inflation are currently higher than the risks to growth.

He said, “Resilient growth gives us the space to remain focussed on inflation and maintain status quo till some of these risks are mitigated and the trade-offs are minimised.”

Since the last monetary policy committee meeting, risks to the global economic outlook have increased, while the domestic economy continue to exhibit resilience. Domestically, risks to inflation are higher than risks to growth at the margin

Prof. Jayanth R. Varma, member, MPC, reiterated his concerns about the excessive restrictiveness of current monetary policy and its impact on growth.

He said, “For the last several meetings, I have been expressing concerns about the unacceptable growth sacrifice induced by a monetary policy that is excessively restrictive.”

He added, “The RBI’s projections show inflation bouncing up and down from quarter to quarter, but the trend line is clearly downward, and the projected inflation for the first quarter of 2025-26 is 4.4 per cent. On a forward looking basis, the current repo rate of 6.5 per cent translates into a real rate of 2.1 per cent. This is well above what is needed to drive inflation to the target of 4 per cent.”

Dr Ashima Goyal, member, MPC, echoed Varma’s concerns and voted for a 25 basis points cut in the repo rate, advocating for a shift to a neutral stance. She highlighted global uncertainties, including the potential for a rate cut by the U.S. Federal Reserve, and noted that market rates in India were already coming down as liquidity improved with government spending.

She said, “We are seeing market rates coming down as liquidity improves with government spending. The call money rate is also near the repo rate. This should be maintained. Adequate liquidity is required along with prudential policies that create good incentives for the financial sector (P8), especially since the sources of liquidity are limited for many parts of India’s financial sector leading to liquidity hoarding. Balance requires that over strictness is avoided.”

Dr Shashanka Bhide, member, MPC, supported the decision to keep the policy repo rate unchanged at 6.5 per cent and emphasized the need to focus on withdrawing accommodation to ensure inflation progressively aligns with the target.

He said, “Persistent food inflation may require core inflation to soften sufficiently to maintain the headline close to the target. High food inflation would therefore hit growth adversely as it affects consumption and require restrictive monetary policy to soften core inflation, especially when faced with significant spillovers of persistent food price pressures to core components.”

The Balochistan Liberation Front (BLF) has claimed responsibility for a sweeping wave of armed assaults…

Union Minister of State for External Affairs Pabitra Margherita reaffirmed the "strong and enduring bonds…

Prime Minister Narendra Modi on Saturday distributed over 51,000 appointment letters to newly appointed youth…

Union Health Minister and BJP National President JP Nadda engaged with the Chairman of the…

India's direct tax collections, in gross terms, have witnessed a robust growth of 3.2 per…

The Ministry of External Affairs (MEA) has underlined India's increasing involvement in the Indo-Pacific region,…