The Reserve Bank of India (RBI) today hiked the repo rate – the rate at which banks borrow from the central bank—by 35 basis points, which was on expected lines. The key interest rate now stands at 6.25 per cent. The cycle of raising interest rates began in May in an off-cycle RBI meet.

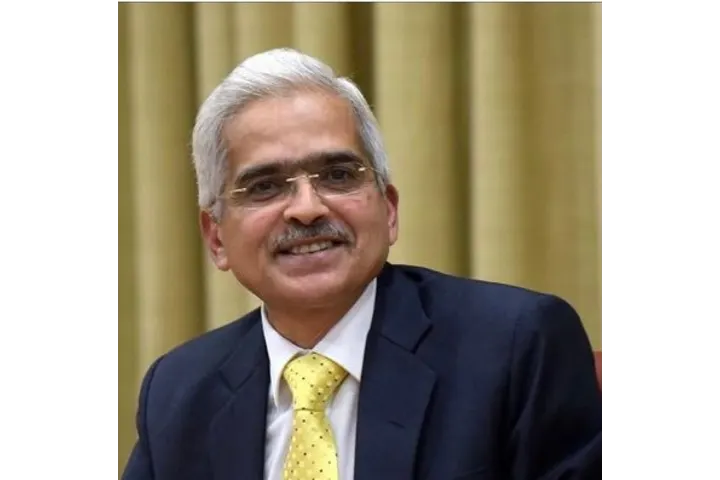

RBI Governor Shaktikanta Das said that India’s growth story continues to be strong. However the central bank reduced the country’s growth forecast to 6.8 per cent for the current fiscal year from the earlier 7 per cent. The World Bank on Tuesday revised upward its growth projection for India from 6.5 per cent to 6.9 per cent.

The expected moderation in the pace of tightening happened. It stems from rising external risks to growth, and reduced upside risks to inflation because of a material fall in crude oil prices. To be sure, and as the RBI Governor has highlighted, the inflation battle is far from over because the sticky core continues to put pressure on the headline,” Dharmakirti Joshi, Chief Economist, CRISIL said, adding that today’s rate hike was to break that core-inflation persistence.

The RBI maintained the consumer price index (CPI) inflation forecast at 6.7 per cent.

The annual inflation in October stood at 6.77 per cent, down from 7.41 per cent in September, which was a five-month high. The hike in repo rate indicates that the RBI will continue to focus on inflation despite moderation in food prices.

“The Indian economy remains resilient and the country is seen as a bright spot in a gloomy world,” Das said as he read the bi-monthly monetary policy outcome.

Last month Deloitte in a report said that it expected India’s growth rate to clock between 6.5 per cent and 7.1 per cent in the current financial year.

“India to post a 6.5-7.1 per cent growth during 2022-23 and 5.5-6.1 per cent the following year contingent on the revival of the global economy and improving economic fundamentals,” it said.

Also read: World Bank pegs India’s growth rate at 6.9%, up from the earlier 6.5%