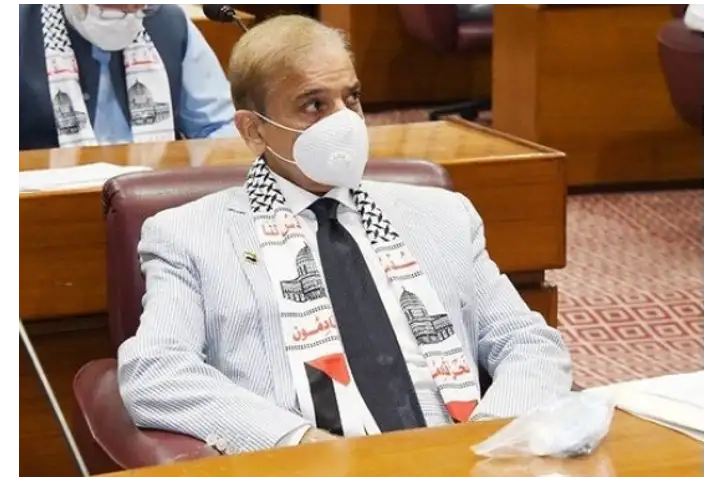

Pakistan’s economic crisis is just getting deeper. With the surge in its import bill amid depleting foreign exchange reserves, Islamabad is inching towards bankruptcy. The Shehbaz Sharif government has to take drastic measures that will boost its foreign exchange reserves.

The Shehbaz Sharif government has opened talks with Saudi Arabia and China for financial assistance but the two countries are unwilling to disperse any large amounts until Islamabad receives the proposed bailout package from the International Monetary Fund (IMF).

That apart, China’s domestic economy is under pressure with the resurgence of fresh Covid 19 cases. “China will be cautious at this juncture to provide any significant assistance to Pakistan, especially after three Chinese nationals were killed,” an analyst told India Narrative. Last month, in a suicide bombing carried out by a female Baloch bomber, three Chinese national were killed just outside the University of Karachi's Confucius Institute – the Chinese language teaching centre.

Such terror attacks could also jeopardise inflow of foreign investments from Beijing.

As many as 25 power producing companies, which are part of the China Pakistan Economic Corridor (CPEC), have also asked for payment of all outstanding dues. A few of them have even threatened to shut down operations if payments are not made.

“The going is tough for the current administration and the problems are multiplied with (former Pakistan PM) Imran Khan’s massive public rallies which shows that he still has huge support—this makes the country even more unstable, at least politically,” a foreign policy watcher told India Narrative.

Analysts are unanimous in their opinion that Pakistan must immediately adopt stringent and out of the box measures to arrest the economic fall.

With the surge in global crude oil prices, Islamabad will have to carve out ways to ration petrol and diesel.

"The risk of default may loom large in fiscal year 2023, so there is a need to curtail imports of both goods and services in the range of $5 billion and $2 billion respectively. Without saving dollars, we cannot avert default risks," ex-chairman Shabbar Zaidi, the Federal Board of Revenue – an enforcement agency dealing in financial crime told Karachi based newspaper The News.

Zaidi prescribed closing down all shopping malls, and bazaars by 6 pm and curb use of fuel especially for bigger vehicles.

The cash starved country has also been hit by massive power outages due to fuel shortage along with technical glitches.

Pakistan’s former Prime Minister Imran Khan just before being voted out of power, slashed prices of petrol and other commodities till the Budget Session in June. The subsidies would cost about $2.1 billion to the exchequer. Though the move, which violated the IMF conditions, came under severe criticism, the Sharif government has not rolled it back. This retention will put enormous pressure on the exchequer and exacerbate an already festering situation, a report by Observer Research Foundation said.

Also read: Angry Imran Khan steps up tirade against Army chief Bajwa

Sri Lanka is not alone, several other countries are facing an economic meltdown