Cash starved Pakistan, which is currently in talks with the International Monetary Fund (IMF) for resumption of the $6.5 billion loan programme has been miffed by the multilateral agency, which is playing tough this time with Islamabad. Though after much mediation, the two have gone back to the drawing board, the IMF’s list of demands required for resumption of the loan has been expanding continuously.

Local newspaper Dawn said that IMF has changed interpretations of at least four prior actions ahead of reaching a staff-level agreement (SLA) on the direly needed economic bailout.

“We are members of the IMF, not beggars or else our membership be discarded,” the newspaper quoted an unnamed official as saying.

Earlier an embarrassed Pakistan Prime Minister Shehbaz Sharif said that his government has had to accept the strict conditions set by the IMF “unwillingly.” His government has also approved a Rs 170 billion mini budget as part of the IMF’s demand for the loan. Islamabad has agreed to impose fresh taxes, end unbudgeted power subsidies, increase gas and petroleum tariffs, among other things.

This would push up inflation further and this is causing more worries for the Shehbaz Sharif government, which will face elections later this year.

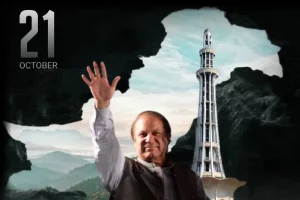

Sharif has also come criticism by his own party member. Maryam Nawaz Sharif, his niece and daughter of PML-N supremo Nawaz Sharif, came out strongly opposing his decision to hike taxes, saying that the party supremo was not involved in this decision making.

“This is not my government. Our government will be when Nawaz Sharif returns to Pakistan,” Maryam Sharif said at a youth wing meeting, reported the Express Tribune. She also underlined that only her father could take Pakistan forward.

The loan programme was signed in 2019 by former prime minister and PTI leader Imran Khan. It was stalled after his government failed to adhere to the prescription set by the multilateral agency. While Miftah Ismail, former finance minister under the Sharif government was instrumental in resuming the loan programme, it ran into rough weather after current Finance Minister Ishaq Dar reversed the policies.

However, amid rising debt levels and staring at a default, Dar has now been forced to increase fuel prices.

Meanwhile, amid the deepening crisis, yesterday, global ratings agency Moody’s downgraded Pakistan. The ratings have fallen to Caa3 from Caa1.

Also read: Moody’s downgrades Pakistan’s rating amid depleting forex reserves