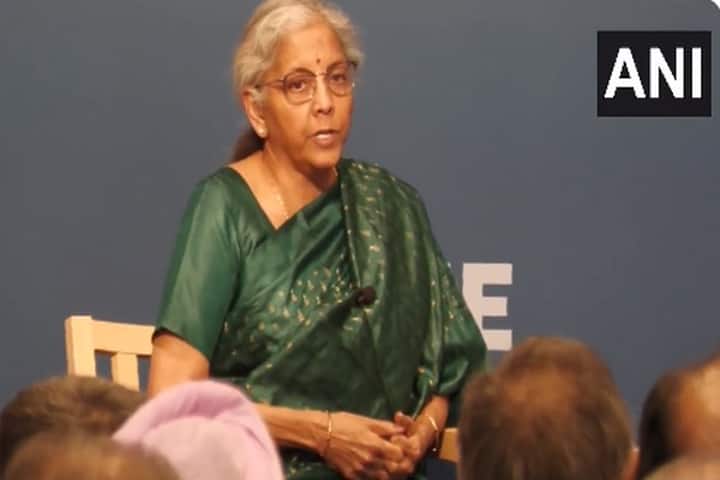

With rising debt burden hitting the Global South hard, Finance Minister Nirmala Sitharaman, who is in the US to attend the spring meetings of the International Monetary Fund (IMF) and World Bank, underlined the need to develop a multi-pronged approach to address the issue. Earlier, there were “some disagreements” among the G20 members on the issue of debt restructuring.

Debt distress in many countries, especially those that belong to the Global South has become a cause for serious concern. Global debt distress would not only slow down the economic recovery process but also push poverty and hunger levels across the world.

The Global South— countries with lower socio-economic development—are the worst impacted with a surge in debt levels.

Unsurprisingly therefore, Sitharaman’s US visit is being keenly watched across the world. India, which currently holds the G20 presidency, is keen to be perceived as the credible voice of the under-developed and developing nations.

“We strongly believe there should not be any first world or a third world, but just one world with a shared understanding for a common future,” Sitharaman said earlier speaking at the Voice of Global South Summit.

Rising debt distress in South Asia is also becoming a cause for concern. The situation is particularly worrisome in countries including Sri Lanka, which defaulted last year and Pakistan. Both the countries are negotiating with the IMF for a bailout package.

Besides multilateral lenders and other agencies, China, which is not even part of the Paris Club, has now become the largest bilateral creditor.

“As a priority for the #G-20 India Presidency, FM Sitharaman said that there is need to augment present global efforts, including those of the #G20 to address growing debt distress across the globe,” the finance ministry said in a tweet.

Sitharaman is not alone. Union Ministers Piyush Goyal and S Jaishankar too who are currently outside the country, pointed out India’s keenness to become the voice of the Global South.

Last year, the World Bank said that about 58 per cent of the world’s poorest countries were in debt distress or at high risk of it “and the danger is spreading to some middle-income countries as well.”

“High inflation, rising interest rates, and slowing growth have set the stage for financial crises of the type that engulfed a series of developing economies in the early 1980s,” it said.

Earlier this year, the United Nations Conference on Trade and Development (UNCTAD) said that a full-blown development crisis with debt distress at its core threatens a new lost decade for much of the world economy. Global debt distress would not only slow down the economic recovery process but also push poverty and hunger levels across the world.

Meanwhile, the Finance Minister along with Reserve Bank of India Governor Shaktikanta Das also chaired the first of the two day 2nd G20 Finance Ministers and Central Bank Governors (FMCBG) meeting with a sharp focus on the issue of tackling global debt vulnerability.

Sitharaman called for strengthening the multilateral development banks. An expert group has already been formed last month to oversee the issue of multilateral development banks.

Sitharaman has a packed schedule in the US. She has held a host of meetings and discussions. Among others she met US Treasury Secretary Janet Yellen and IMF’s first deputy manager Gita Gopinath.

Also read: Debt distress, taxation, crypto regulation to be focus during India’s G20 presidency