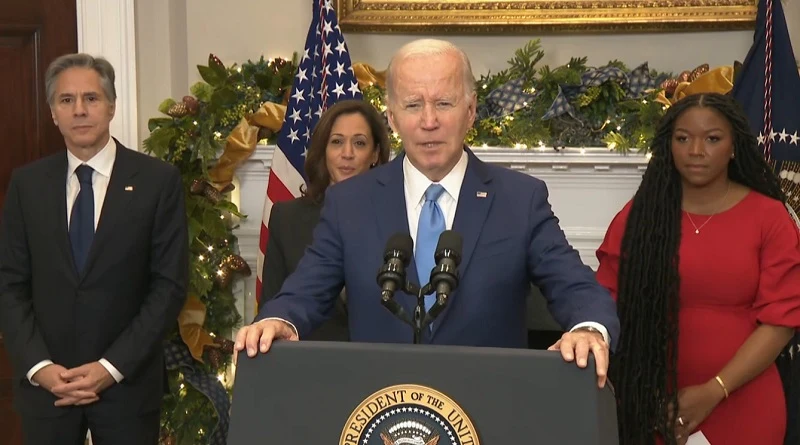

US President Joe Biden to hold a meeting with Republican leaders to discuss the issue of raising debt ceiling

The spotlight is on Washington. Will it manage to avert a debt default? If the debt ceiling – the maximum amount that a country can borrow — is not enhanced immediately, the world’s largest economy could run out of money in less than a month. The White House noted that “a protracted default would likely lead to severe damage to the economy, with job growth swinging from its current pace of robust gains to losses numbering in the millions.” That is not all. The cost of insuring US debt has also risen substantially touching an all-time high, reflecting increased worries about a default, it added.

US President Joe Biden is slated to meet Republican leaders tomorrow to discuss the issue of raising the ceiling at the earliest. US Treasury Secretary Janet Yellen has warned that if an agreement is not thrashed out in the next few days, the economy would crumble. Yellen has also pressed the alarm bell saying that such decisions, when pushed to the last moment only dent investors’ confidence and business environment.

The total national debt as of January 2023 stood at $31.4 trillion. The debt to GDP ratio was 129 per cent in 2022, as per Trading Economics.

While in April, the House of Representatives passed a bill allowing the ceiling to be raised by $1.5 trillion, it has added stringent riders that include massive spending cuts. Biden is against any conditions.

A report by NPR said that though the Treasury Department has said it is taking “extraordinary measures” to prevent a default, “some state treasurers worry about the impact on their budgets and residents.”

The US government has run a deficit averaging nearly $1 trillion every year since 2001, said the Council on Foreign Relations. Simply put, this means that the country has been spending way more than it earns in the form of taxes and other revenue. But the country’s borrowing has been increasing continuously to enable the government to make the necessary spendings and payments.

The US, which has resorted to raising the debt ceiling more than 78 times since 1960, last increased the limit in late 2021 to $31.4 trillion. The US has also suspended the debt limit seven times since 2013.

Sources said that a large number of Americans are unhappy with the way Washington imposed sweeping sanctions on Russia after Moscow’s Ukraine invasion.

“These measures were hurriedly imposed without even analysing the impact they will have on the global economy and more importantly on the US itself,” an analyst told India Narrative.

The Washington Post in a report published in February this year said though the “initial impact of sanctions looked deadly, causing the ruble to crash, the banking system to shudder and companies worldwide to stop exporting vital goods to Russia,” one year later, “Russia has remained more resilient than many expected.”

Also read: PM Modi rated world’s most popular leader again ahead of Joe Biden

Taiwan detected one sortie of Chinese aircraft, eight Chinese vessels and one official ship until…

Baloch activist Mahan Baloch delivered a powerful intervention that shed light on the ongoing human…

Prime Minister Narendra Modi spoke with the Myanmar military junta chief, Min Aung Hlaing, and…

The United Nations Human Rights Council (UNHRC) witnessed a strong intervention from Jamil Maqsood, the…

Union Home Minister Amit Shah on Saturday hailed the success of security forces in a…

India has launched 'Operation Brahma' to support earthquake-impacted Myanmar. Indian Air Force C-130 J aircraft…