Indian banking sector NPA (Infographic: FICCI-IBA)

The health of the Indian banking sector continues to improve with better asset quality and high credit growth, a survey conducted by industry body FICCI and banking association Indian Banks’ Association (IBA) showed.

The eighteenth round of the survey was carried out for the period July to December 2023.

Those banks that were surveyed together represent about 77 per cent of the banking industry, as classified by asset size.

India’s economy held relatively well (estimated 7.6 per cent) in 2023-24 compared to other major economies driven by strong investment growth and a rebound in industrial activity.

Credit growth also continued to rise, supported by factors such as economic expansion and a continued push for retail credit which has been supported by improving digitalisation. The banking sector’s clean balance sheets support further loan growth going forward.

The survey findings showed that long term credit demand has seen continued growth for sectors such as Infrastructure, metals, iron and steel, food processing. Infrastructure is witnessing an increase in credit flow with 82 per cent of the respondents indicating an increase in long-term loans as against 67 per cent in the previous round.

The joint survey suggested that the outlook for non-food industry credit over next 6 months is optimistic with 41 per cent of the participating banks expecting non-food industry credit growth to be above 12 per cent while 18 per cent feel that non-food industry credit growth would be in the range of 10-12 per cent.

Further, 36 per cent of the respondents are of the view that non-food industry credit growth would be in the range of 8-10 per cent.

Customers’ search for higher rates and the ability to lock those interest rates for a longer time has led to a shift in favour of term deposits. As such, term deposits have picked up pace as reported by the respondent banks. Further, around 70 per cent respondents have reported a decrease in the share of CASA deposits in total deposits.

According to the survey, 65 per cent of respondent banks reported credit standards for large enterprises to have remained unchanged as against 54 per cent in the last round.

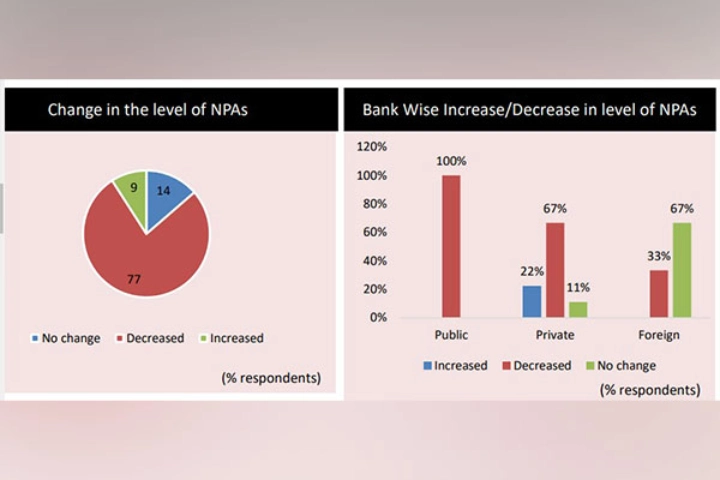

On asset quality, a large majority (77 per cent) of the respondent banks reported a decrease in the NPA levels in the last six months. All responding PSBs have cited a reduction in NPA levels while amongst participating Private sector banks, 67 per cent banks have cited a decrease.

None of the respondent PSBs and Foreign banks have stated an increase in NPA levels over the last six months while 22 per cent private banks reported an increase. Amongst the sectors that continue to show a high level of NPAs, most of the participating bankers identified sectors such as food processing, textiles, and infrastructure.

Banks were more sanguine about the asset quality prospects in the current round of the survey, cushioned by policy and regulatory support and this was reflected in the survey results, it said.

Over half of the respondent banks in the current round believe that Gross NPAs would be in the range of 3-3.5 per cent over the next six months. 14 per cent respondents are of the view that NPA levels would be in the range of 2.5-3 per cent.

Taiwan detected one sortie of Chinese aircraft, eight Chinese vessels and one official ship until…

Baloch activist Mahan Baloch delivered a powerful intervention that shed light on the ongoing human…

Prime Minister Narendra Modi spoke with the Myanmar military junta chief, Min Aung Hlaing, and…

The United Nations Human Rights Council (UNHRC) witnessed a strong intervention from Jamil Maqsood, the…

Union Home Minister Amit Shah on Saturday hailed the success of security forces in a…

India has launched 'Operation Brahma' to support earthquake-impacted Myanmar. Indian Air Force C-130 J aircraft…