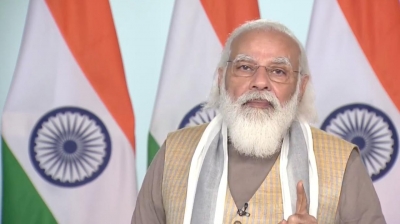

India has launched its own digital currency – e RUPI. As Prime Minister Narendra Modi launched the e RUPI, India became the second country in the world after China to have a digital currency.

Developed by the National Payments Corporation of India, (NPCI), this would be an e-voucher based digital payment solution, which is expected to be leak-proof delivery mechanism especially for the social welfare schemes.

Unlike cryptocurrencies, digital or virtual currency is issued by central banks and is known as “central bank digital currency” or CBDC. This facilitates cashless payments and can be undertaken by smartphones or electronic cards. Importantly, a CBDC is backed by a central bank unlike a cryptocurrency. Thus, in this the e RUPI will be pegged to the rupee.

What is the difference between digital currency and cryptocurrencies?

For many, digital currency may seem slimier to a cryptocurrency. The two are not similar though both are electronic.

Essentially, digital currency is the electronic model of the physical currencies. They have the same value which can be stored in a digital wallet. But these can also be converted into physical cash, whenever needed. “It is intangible cash with an open-source contactless transaction flow between two parties,” Analytics Insight noted.

Also read: Sitharaman says RBI will take a final call on cryptocurrency

Cryptocurrency, the encrypted form of digital currency, are not necessarily backed by the central banks. Therefore they are “highly volatile in the global investment market.” The cryptocurrency has different names with respective companies who launched it in the market— Bitcoin, Ethereum, Dogecoin, and many more. Digital currencies or in case of India, the e RUPI will come under the ambit of the Reserve Bank of India, while cryptocurrencies are not regulated.

Is it important to have digital currency?

While this form of currency is still not common, analysts have said that the future is in digital wallet as the world moves more towards electronic transactions. Forms of currencies have been changing since time immemorial. During ancient times, the primary form of currency was coins made of metals, often with gold and silver. Later paper currencies were introduced.

Analysts said that as the forms of payment mature and develop, the future is in digital transaction.

The statement by the Prime Minister’s Office said, "It is expected to be a revolutionary initiative in the direction of ensuring a leak-proof delivery of welfare services. It can also be used for delivering services under schemes meant for providing drugs and nutritional support under Mother and Child welfare schemes, TB eradication programmes, drugs and diagnostics under schemes like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertilizer subsidies etc."

Which other countries have digital currencies?

China has been developing its digital yuan since 2014 under the aegis of the People’s Bank of China. Beijing, with the aim of breaking the dominance of the US dollar has been moving fast on its plan. It has already launched the digital yuan in a limited manner, though a nationwide launch is yet to take place.

Several countries including Russia and Japan are experimenting with this new form of payment mechanism.

A report in the Japan Times said that Tokyo is preparing to issue its own digital currency in both the public and private sectors.

“Demand (for a CBDC) could be suddenly strong. We aim to be well-prepared to respond to changes in our environment,” the Japan Times quoted BOJ governor Haruhiko Kuroda as saying.

Russia too is preparing a concrete plan for its own virtual money. According to a report in the Finance Magnates, Russia’s largest state-owned lender, Sberbank, is set to launch its own digital currency sometime soon.